"Torque Affair" (torqueaffair)

"Torque Affair" (torqueaffair)

01/17/2016 at 12:54 ē Filed to: CAR BUYING

18

18

100

100

"Torque Affair" (torqueaffair)

"Torque Affair" (torqueaffair)

01/17/2016 at 12:54 ē Filed to: CAR BUYING |  18 18

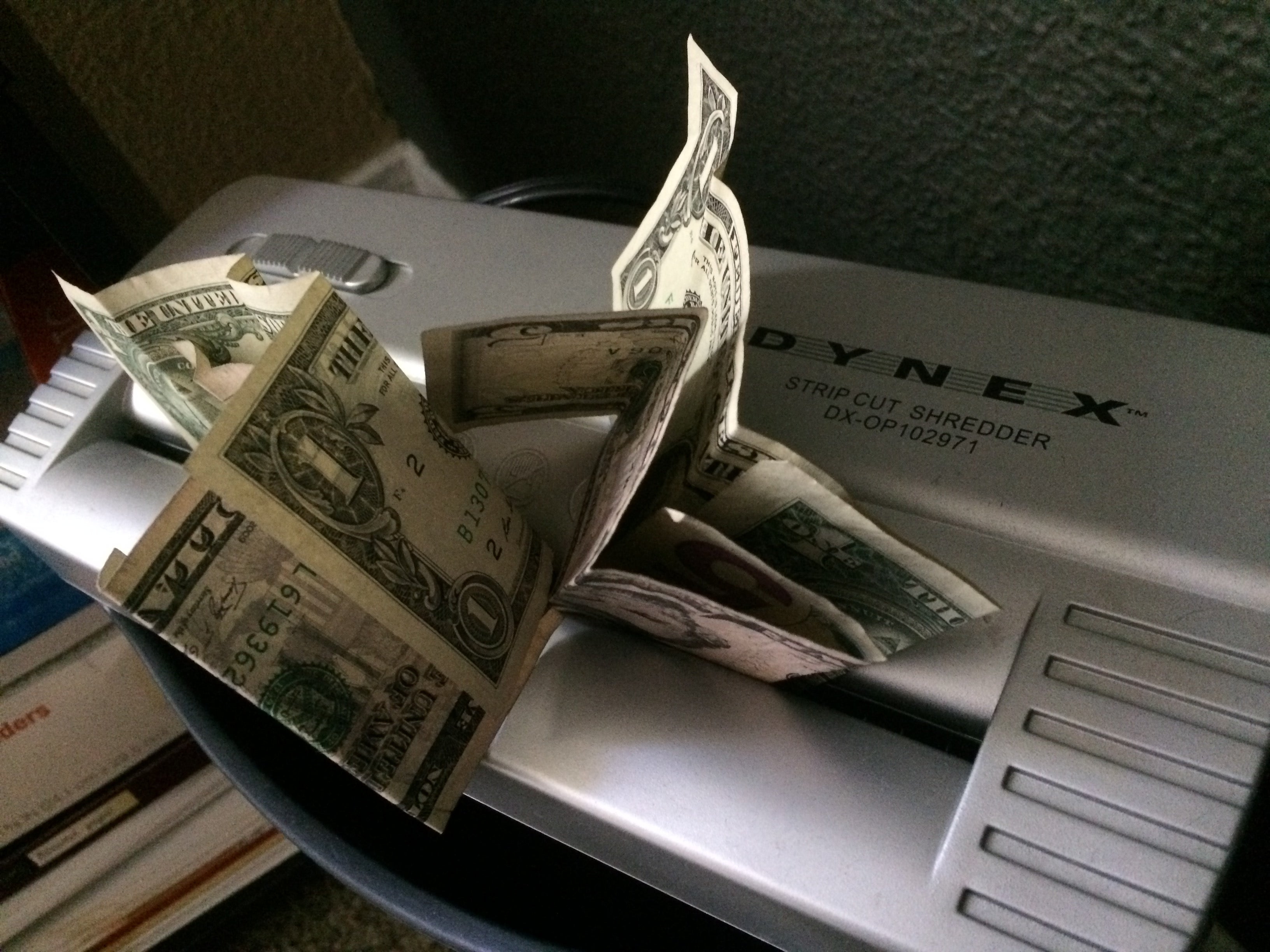

|  100 100 |

I now know what it feels like to literally throw money down the drain. Let me rephrase. I know what itís like to take hundreds of dollars, rip them them shreds and then toss them down a garbage disposal. That is exactly what I experienced with my most recent car purchase and I donít want to repeat this again.

When youíre looking to buy a car at a dealer, the financing is straightforward since the dealer can set up something for you easily. However, if you spot a car on Craigslist or Autotrader that you want to buy from a private seller, then you have to take it upon yourself to find the money. Assuming you donít have a bunch of cash sitting in your bank account, you have a few options available to you to make that car purchase a reality:

a) Rob a bank

b) Beg your parents for money

c) Ask your buddy whoís a partner at a law firm for some cash (he has more money than he knows what to do with)

d) Get a loan from a bank or a credit union

I briefly considered option ďcĒ but then I thought that I need to save ďcĒ for when I want to buy a yacht. For now, I decided to go to my local credit union, since they were offering me a good rate.

I remember when University Federal Credit Union (UFCU) used to offer auto loans which you could easily obtain to purchase used vehicles from individual owners but for some reason they stopped doing that. It was such a simple process. They just provided you the loan at a good rate (assuming you didnít have $30K in credit card debt that you didnít bother paying off) and youíd take that to buy the car of your dreams from Carl next door.

However, these days, the only way to do this at the credit union is to get a personal rate at an astronomical rate, and then once the title is transferred to your name with UFCU as the lien holder, the loan would be converted to an auto loan at which point the rate would go back down to a more tolerable level. This is what I did last year with the !!!error: Indecipherable SUB-paragraph formatting!!! and it worked out perfectly. I bought the BMW using a private loan with the ridiculously high rate of 11.9%, got the title transferred, attached UFCU as the lien holder and then the following day, the loan was converted to an auto loan at the low rate of 1.9%.

I figured that with my most recent purchase, a !!!error: Indecipherable SUB-paragraph formatting!!! , the process would be as smooth and painless as it was with the BMW. The seller had financed through the same credit union and so I thought, ďGreat, it will be so easy to do this transaction!Ē Wrong! Instead, it resulted in the same thing as taking money out of your bank account and throwing it in the trash along with your empty milk carton.

Lesson 1: Never assume that a car buying transaction will be ďeasy.Ē It will be probably be terrible. Go in with the worst expectations and then maybe, just maybe , the transaction wonít be quite as painful. Itís like when you go to Chipotle to eat. Just assume youíll throw up afterwards and so when you actually do, it wonít be as much of a shock.

Somehow, going through UFCU for both of us did not make one bit of difference. It was still an involved process; UFCU would have to first inform the DMV to release the lien on the title and then send over the cleared title to me.

After UFCU made both myself and the seller fill out a bunch of paperwork, I expected the title to show up in the mailbox. However, after a week and a half of waiting, the only thing I got in the mail were Dove soap coupons and holiday cards from people with pictures of them vacationing in New Zealand, Turkey, Iceland - yes, you have a better life than me - I get it.

I checked with UFCU and after looking into itthey told me that they sent it to the wrong address.

WHAT?!? Nooo!!!

And, so now, the title was lost somewhere out there in the snail mail world. Here is a question. Isnít it about time we got rid of paper mail completely? Why does it need to exist?

Losing the title meant that I was stuck in DMV hell. Even if the title was somehow returned to the DMV, the likelihood of which was lower than someone winning the powerball lottery, the only option at that point was to get the seller to show up and request a certified copy of the title, which would then be transferred to me.

Now here is where it gets worse. I thought that I could get a hold of the previous owner easily, but I couldnít. Because all of this mess unfolding during Christmas and New Years, when everyone was mostly intoxicated, the seller didnít return my call or text messages. How dare he take some time off during Christmas and New Years?! Doesnít he know that I might have issues with paperwork and should therefore be available 24/7??

Lesson #2 - Donít buy a car from someone during the holidays. You probably wonít be able to get a hold of the seller because the last person they will think of is you. The seller just sold you a car they probably didnít want, paid off a car loan and now has some extra money that is being used to go to France to ring in the New Year. You are as important to the seller as dryer lint.

I started getting worried. What if I never hear from the previous owner again? What if I canít get a hold of the title? Would I be stuck with a $28,000 loan with 11.9% interest? I am so screwed.

Paranoia set in. I now had this 2008 IS-F that I was regretting purchasing.

So I waited, impatiently, with increasing levels of stress, and started checking my phone every few seconds, hoping that if I stared at it long enough, I would get a call. It was like waiting around to get a text or a call from someone you went on a date with recently. Is a simple text too much to ask for? But, things went so well!

Meanwhile, the 11.9% loan continued to accrue massive amounts of interest.

Finally after a week, I got a call from the seller. Yes! What a relief ÖohÖwait. Not so fast. Now, I actually had to schedule a time to meet the seller at the DMV. We went back and forth for several days to try to find a time that worked for both of us.

On 1/11/16, the title transfer took place. I bought the car on 12/10/15 meaning that an entire month passed by with 11.9% interest being added to $28,000. Want to guess how much money I wasted?

$300 - interest only!

I couldíve spent that money on dinner at a Michelin-starred restaurant in Chicago and then gone to Wendyís to fill up afterwards.

So here I am, out $300, for the dumbest reason ever. Iím sure UFCU loves me because they got exactly what they wanted - Iíll never fall for that trick again.

Lesson #3: Do not go this route when financing for a car. Find some other way. Just ask your parents for a loan. Itís so much easier and if youíre nice to them, you may not even have to pay them back!

!!! UNKNOWN CONTENT TYPE !!!

!!!error: Indecipherable SUB-paragraph formatting!!! is about exploring my fascination with cars. Iím always on the lookout for things that interest me in the car world.

Follow !!!error: Indecipherable SUB-paragraph formatting!!!

Jon Clark

> Torque Affair

Jon Clark

> Torque Affair

01/17/2016 at 13:10 |

|

Wow. You had a doozy of an experience. Thanks for sharing.

davedave1111

> Torque Affair

davedave1111

> Torque Affair

01/17/2016 at 13:11 |

|

Have you tried complaining to the credit union? It seems a bit off for them to make a profit out of their own mistake. Normally such things are actually illegal, but even if not, itís unlikely to go down well with regulators.

ďUniversity Federal Credit Union (UFCU) used to offer auto loans which you could easily obtain to purchase used vehicles from individual owners but for some reason they stopped doing that.Ē

As far as I know, itís now illegal - or rather, the interest rate theyíre allowed to charge is capped at a lower rate than the cost of lending, so theyíre effectively banned from doing that.

Birddog

> Torque Affair

Birddog

> Torque Affair

01/17/2016 at 13:20 |

|

ďI couldíve spent that money on dinner at a Michelin-starred restaurant in Chicago and then gone to Wendyís to fill up afterwards.Ē

And now you owe me a keyboard. Geez.. You really know how to blow through money!

I have a similar story from my late teens. I found an S-10 BAJA that I just HAD to have. I had no credit history at the time so HSBC set me up with a loan. A personal line of credit really. A revolving line of credit. At 10%.

Yeah.. That $9000 truck wound up costing close to $24,000 by time I paid it off.

better red than dead

> Torque Affair

better red than dead

> Torque Affair

01/17/2016 at 14:03 |

|

The idea of my aging parents having $30k to loan me is... adorable. Oh god theyíre going to be eating cat food and Iím going to have to put them up in a single bed in my condo like the Wonka family and oh god

Dr. Zoidberg - RIP Oppo

> Torque Affair

Dr. Zoidberg - RIP Oppo

> Torque Affair

01/17/2016 at 14:07 |

|

Sounds like a headache, but only 300 bucks... Compare this to the trials and tribulations of the average-income consumer, whose new used carís engine explodes 6 miles down the road.

jimz

> Birddog

jimz

> Birddog

01/17/2016 at 14:10 |

|

my personal rule is always pay ahead as much as possible. (step one of that is ďdonít finance a car for which you can just barely make the minimum monthly payment.Ē) my last two financed vehicles I paid off in 2.5 years and 2 years on a 60 month note.

lithy

> Torque Affair

lithy

> Torque Affair

01/17/2016 at 14:21 |

|

You just bought a massively depreciating $28k asset with annual registration, insurance and maintenance costs and youíre worried about 300 bucks?

sklooner

> Torque Affair

sklooner

> Torque Affair

01/17/2016 at 14:38 |

|

The cu screwed up they should eat the interest

Quade

> Torque Affair

Quade

> Torque Affair

01/17/2016 at 14:46 |

|

My takeaway is never buy a car that doesnít have a clear title. Itís a rule everyone should follow. Iím not handing over cash unless I get the title immediately.

ferric oxide

> Torque Affair

ferric oxide

> Torque Affair

01/17/2016 at 14:48 |

|

Are you sure you couldnít get a loan approval from a FCU without a title transfer? When I did mine all they needed to do was inspect/appraise it first. I expect that it did help that I was putting 50% down on a 6 year old car though.

If thatís whats going on I...would really start looking for a different credit union.

I canít imagine what people do trying to finance a Ďclassicí car though. I suspect having the money, cooking meth, and robbing banks are pretty much your go to options there.

iceman

> better red than dead

iceman

> better red than dead

01/17/2016 at 14:48 |

|

Yeah but...Youíll have a sweet ride

gr8scotny

> Torque Affair

gr8scotny

> Torque Affair

01/17/2016 at 14:50 |

|

Really? This big article over a small mistake that should have been rectified by the FCU? Hate to see you when some thing REALLY meaningful comes your way. Man up.

Quade

> davedave1111

Quade

> davedave1111

01/17/2016 at 14:50 |

|

It seems to me itís two completely different transactions.

1 - He took out a loan at 11.9%

2 - He used it to pay off some other guyís car and had to wait for the title.

The fact the CU screwed up sending the title doesnít change #1.

Birddog

> jimz

Birddog

> jimz

01/17/2016 at 14:54 |

|

Oh, I learned my lesson. It was painful but stupid hurts. Later in life when my then wife was interested in a new car we did things way differently. Much like you we paid a 5 year note off in 3 and we put enough down to not be underwater on day 1.

ferric oxide

> Dr. Zoidberg - RIP Oppo

ferric oxide

> Dr. Zoidberg - RIP Oppo

01/17/2016 at 14:55 |

|

Agree 100%. That is full on $4-7K of credit card debt. If youíre making the minimum monthly payments Iím sure you can knock it out in 15 or 16 years though.

...which is why average income consumers should always have their cars inspected by an independent mechanic before any major used car purchase.

Itís still no guarantee, but a compression/leak-down/general inspection is well worth the money. An independent mechanic can also tell you what a piece of crap this particular make/year/model is because he sees one of them in their shop every month or two.

GLiddy

> Torque Affair

GLiddy

> Torque Affair

01/17/2016 at 15:17 |

|

Its probably asking too much these days, but only buy cars for which the seller has clear title in hand. I love to save money as much as the next guy, but going through crap like this is why I feel safer just going to a dealer. I can feel confident that they will deliver clear title.

Now you know there is risk in doing these deals. You played with fire and got burned for your trouble.

didyourlysaythat?

> Torque Affair

didyourlysaythat?

> Torque Affair

01/17/2016 at 15:19 |

|

So the credit union that sent the title to the wrong address isnít responsible? Something tells me you should have made a bigger stink there and possibly had that extra interest waived due to their error.

Eldiablo

> Torque Affair

Eldiablo

> Torque Affair

01/17/2016 at 15:24 |

|

Hows bout living within your means and buying a Camry ? Poor me, I all I wanted was a $50,000 car so my $40,000 car wouldnít be lonely.

Daveypetey

> Torque Affair

Daveypetey

> Torque Affair

01/17/2016 at 15:30 |

|

Pentagon federal credit union had been painless 3 times in the last 4 years.

KusabiSensei - Captain of the Toronto Maple Leafs

> Torque Affair

KusabiSensei - Captain of the Toronto Maple Leafs

> Torque Affair

01/17/2016 at 15:30 |

|

11.9% APR? And you took it?

My God...even my CU isnít that usurious...a MY2008 car would be around 4.15% APR. The oldest they write loans on is MY2007, and thatís 4.95%, which is still leagues better than 12 freaking percent.

EDIT: Ah, saw it was a signature loan. Still holds true. My APR on a signature loan for that amount would be 6.95% APR, which is still better than the BHPH shops around town.

Chasaboo

> Torque Affair

Chasaboo

> Torque Affair

01/17/2016 at 15:33 |

|

I agree, it does not seem right that you be held culpable for their error.

Das

> Torque Affair

Das

> Torque Affair

01/17/2016 at 15:42 |

|

You need to find a new credit union. Mine has no problem issuing a loan for a private party sale, all we need to do is go into a branch, and they even handle all the DMV paperwork. This article might be better suited for Yelp.

tapzz

> Torque Affair

tapzz

> Torque Affair

01/17/2016 at 16:04 |

|

... the only thing I got in the mail were [...] holiday cards from people with pictures of them vacationing in New Zealand, Turkey, Iceland

Is that still a thing?

Can you actually still buy postcards anywhere?

DetroitMuscle

> Torque Affair

DetroitMuscle

> Torque Affair

01/17/2016 at 16:06 |

|

Iíd worry a whole lot less about the $300 first month interest than the untold gobs of cash wasted on insurance and depriciation.

Pistons of Fury

> Torque Affair

Pistons of Fury

> Torque Affair

01/17/2016 at 16:07 |

|

Iíll go ahead and file this under F, for #firstworldproblems.

ronmler3

> KusabiSensei - Captain of the Toronto Maple Leafs

ronmler3

> KusabiSensei - Captain of the Toronto Maple Leafs

01/17/2016 at 16:11 |

|

just.....wow.....11.9%.....

ronmler3

> Quade

ronmler3

> Quade

01/17/2016 at 16:12 |

|

Is that you, Steve?

Graflex

> Torque Affair

Graflex

> Torque Affair

01/17/2016 at 16:16 |

|

Go after the CU for your $300 back. The PO turned over the title to them, then THEY were the ones who sent it to the wrong place. As far as Iím concerned, it was their error that prevented you from completing the transaction to be able to change the type of loan.

On top of that, youíre out the extra time, money, and stress of having to meet with the previous owner to fix the title issue.

Other then the headache, the cost to you is an extra $300 on a $28,000 car. Thatís 1.07 % of the price. Could you have done better otherwise, or purchasing from another source (dealer, etc.?) I mean, it sucks, but in the grand scheme of things, is it all that bad?

Graflex

> tapzz

Graflex

> tapzz

01/17/2016 at 16:18 |

|

Everywhere! The problem is finding stamps, then a mailbox. But everyone expects an email - no one expects a postcard, so its a great surprise.

TsarBomba

> Torque Affair

TsarBomba

> Torque Affair

01/17/2016 at 16:44 |

|

And this is why I only buy from a dealer.

Torque Affair

> Graflex

Torque Affair

> Graflex

01/17/2016 at 16:45 |

|

Youíre right, it wasnít that big of a deal. I guess it was more the principle of having a loan out at 11.9%!

Torque Affair

> Pistons of Fury

Torque Affair

> Pistons of Fury

01/17/2016 at 16:45 |

|

Absolutely yes!

Torque Affair

> tapzz

Torque Affair

> tapzz

01/17/2016 at 16:46 |

|

This was something specially created! A customized card...

KusabiSensei - Captain of the Toronto Maple Leafs

> jimz

KusabiSensei - Captain of the Toronto Maple Leafs

> jimz

01/17/2016 at 16:47 |

|

Exception: if you qualify and got the 0% interest deal with the captive finance company.

Then you have no reason to pay early. Well, no *financial* reason. Some people will sacrifice cash flow to remove debt.

As long as you have a plan and are on top of things, youíll be fine.

punksmurph

> better red than dead

punksmurph

> better red than dead

01/17/2016 at 16:48 |

|

My wife keeps a steely eye on my Mother in Laws finances. The last thing we want is the siblings milking her $800K dry in a couple decades and then pawning the mom on us because we actually made something of our lives. My wifeís siblings are just oxygen thieving wastes of carbon that do very little with their lives. The sister lost a job at Target after 10 years of being a shitty employee. The brother works some low level job at a library and is ďHappy with his place in life.Ē They both live at home and just drain resources from the mom. Twice now we have had to tell her mom not to give large sums of money to the kids. It may be harder as she gets older to prevent this, at it just sucks because they would just dump her on us once they used up any money.

Torque Affair

> Dr. Zoidberg - RIP Oppo

Torque Affair

> Dr. Zoidberg - RIP Oppo

01/17/2016 at 16:49 |

|

Oh yea thatís far worse. But, this was more about the principle behind the whole thing...the fact that I had a loan out at 11.9%!

PeeKay

> Torque Affair

PeeKay

> Torque Affair

01/17/2016 at 16:51 |

|

That sucks. For myself, I have always had amazing experiences from my Credit Union. When I was younger I would go to them, give a price range I was looking for, and nearly immediately get approval. But, as I got older that wasnít even required. I didnít even contact them when I traded in my Boxster for a Cayenne Turbo S... There were zero issues, got the best rate and never even spoke to a single person - just told the dealership my bank and it went through.

Stinks that you had to go through that - but I have nothing but praise (at least when it comes to buying cars) for my Credit Union.

KusabiSensei - Captain of the Toronto Maple Leafs

> davedave1111

KusabiSensei - Captain of the Toronto Maple Leafs

> davedave1111

01/17/2016 at 16:52 |

|

The catch is that they wonít write the loan until you have the title. Normally this means someone has to front cash to release the title (unless there is no lienholder on the title).

Most credit unions and banks will give you a grace period of 45 days (or so, not a rule written in law) to get them the title. If you donít, they call the loan and you have to pay it all in one fell swoop.

This one doesnít. So the author took on an unsecured signature loan based solely on his credit score to front the money, and he got burned by paperwork errors.

Unsecured loans do have a higher rate, but I still think 12% is flat usury. My credit union will do it for about half that rate.

Torque Affair

> lithy

Torque Affair

> lithy

01/17/2016 at 16:55 |

|

Wasnít so much about the 300 bucks - itís more the idea that I was wasting money for no reason. At least with the car, Iím getting some enjoyment out of it. Paying extra interest for a loan is the worst!

Eddie Brannan

> Torque Affair

Eddie Brannan

> Torque Affair

01/17/2016 at 16:55 |

|

I was gonna say, if your reaction to losing $300 was ďI could have gone to Alinea!Ē rather than ďI am sleeping in a ditch!Ē then youíre ok, dude. Lesson learned and thanks for sharing as itís good info. Enjoy your new ride!

Torque Affair

> sklooner

Torque Affair

> sklooner

01/17/2016 at 16:56 |

|

Yeah, I talked to them a bunch of times about it - I suppose this is how it works. Didnít fight it too hard though.

Torque Affair

> Eddie Brannan

Torque Affair

> Eddie Brannan

01/17/2016 at 16:58 |

|

Haha...I first learned about Alinea by watching the spinning plates documentary - very curious to try it out.

Torque Affair

> Quade

Torque Affair

> Quade

01/17/2016 at 16:59 |

|

Yeah, that was part of the problem. The title was held by UFCU - again, I thought it would be easier, but it wasnít. Go figure!

Eddie Brannan

> Torque Affair

Eddie Brannan

> Torque Affair

01/17/2016 at 16:59 |

|

That guyís story is pretty amazing. Hope you get to go there. If it was in my town it would be top of my list.

Torque Affair

> ferric oxide

Torque Affair

> ferric oxide

01/17/2016 at 17:00 |

|

Well, the loan was ready to go and approved, but the rate wouldnít apply until UFCU had its name stamped on the title. Itís just a weird system them have set up.

Torque Affair

> GLiddy

Torque Affair

> GLiddy

01/17/2016 at 17:01 |

|

Haha, youíre right. Dealers are the safer route with financing/titles and such. With an individual owner, itís definitely a risk. Learned my lesson!

Torque Affair

> didyourlysaythat?

Torque Affair

> didyourlysaythat?

01/17/2016 at 17:03 |

|

Yeah, I probably couldíve. Iím just glad I got it converted!

Torque Affair

> Eldiablo

Torque Affair

> Eldiablo

01/17/2016 at 17:04 |

|

Oh, yea it wasnít really about the money as much as the fact that I was wasting it for no reason on extra interest.

Torque Affair

> PeeKay

Torque Affair

> PeeKay

01/17/2016 at 17:06 |

|

Yeah, from some of the other comments, it looks like something specific to UFCU? Who knows - iíll have to go a different route next time.

Torque Affair

> KusabiSensei - Captain of the Toronto Maple Leafs

Torque Affair

> KusabiSensei - Captain of the Toronto Maple Leafs

01/17/2016 at 17:07 |

|

Yeah, their auto loan was at 1.9% for me. They would have given that to me if I purchased from a dealer directly - from a private party, they made me go this other way.

Thunder

> Torque Affair

Thunder

> Torque Affair

01/17/2016 at 17:17 |

|

My parents are living off MY hard work, not the other way around, and have been for the past 9 years theyíve lived in my basement. Closer to 11 years if you count when the lived with us in our previous house.

Ask parents for a loan. Bwahahahahaha.

Quade

> ronmler3

Quade

> ronmler3

01/17/2016 at 17:19 |

|

I wish. Be nice to be a Lawyer.

xxxxxxxxxxxxxxxxxx

> Torque Affair

xxxxxxxxxxxxxxxxxx

> Torque Affair

01/17/2016 at 17:28 |

|

Buy with cash, or donít buy. To say you cannot is absurd. You are paying MORE for the car with the payments than if you would save first, paying yourself car payments, and then buying. We simply live in a culture where we want it now and will pay the biggest companies in the world for the privilege of doing so, and sending them money every month as a big fat ďthank you for enslaving me to your monthly needs for my cash.Ē

embassured

> Graflex

embassured

> Graflex

01/17/2016 at 18:00 |

|

Glad you provided this perspective - both for the money saved by private party buyer and for the services offered by the dealer. The average margin on used cars at a dealer is typically in the 20% range. in my experience, I can typically buy via private party a minimum of 10% less than offered by a dealer. Is the merchandising, experience, and financing offered via a dealer worth $2,800? Put another way, is the $2,800 being saved worth the hassle of using your own time energy in securing bank financing, potential lost title, etc? Factor in the $300 extra interest and the time/energy/effort of replacing the title and (my guess is) the buyer came out at least $2,000 ahead of buying from a dealer - and thatís six dinners at Michelin star restaurant!

DamnTheNoise

> Torque Affair

DamnTheNoise

> Torque Affair

01/17/2016 at 18:18 |

|

State Farm Bank has provided me, and clients of mine, with great rates on motorcycles and cars. You donít even have to be a client of theirs.

The agents don't always know the process, but it's pretty straight forward. I'd use them again in a heart beat.

Devon A.

> Torque Affair

Devon A.

> Torque Affair

01/17/2016 at 18:20 |

|

11.9% huh? I recently checked and for me to take out a loan for half of what you got your loan for would be 22.3%.

BeaterGT

> Torque Affair

BeaterGT

> Torque Affair

01/17/2016 at 18:59 |

|

Had no idea you could do that personal-auto loan conversion. I went with the auto loan directly although it was from a different credit union.

Joneez

> Torque Affair

Joneez

> Torque Affair

01/17/2016 at 19:21 |

|

I think my way sounds easier. I paid $400 for my Mazda P5. And it only had two holes in the engine block!

Phil

> Torque Affair

Phil

> Torque Affair

01/17/2016 at 19:22 |

|

What a whiny article about nothing. I'm going to write about the three minutes I just flushed down the toilet.

Torque Affair

> xxxxxxxxxxxxxxxxxx

Torque Affair

> xxxxxxxxxxxxxxxxxx

01/17/2016 at 19:23 |

|

The only way you should pay cash is if you canít get an interest rate thatís lower than 3%. Invest the cash in the market or use it to invest in property - use your money to make you more money!

Torque Affair

> Devon A.

Torque Affair

> Devon A.

01/17/2016 at 19:24 |

|

could be related to credit score?

Torque Affair

> Thunder

Torque Affair

> Thunder

01/17/2016 at 19:25 |

|

Hey, youíre a great son for helping out your parents!

mad.anthony

> Torque Affair

mad.anthony

> Torque Affair

01/17/2016 at 19:30 |

|

Someone shops at Best Buy.

Rand0nS

> Torque Affair

Rand0nS

> Torque Affair

01/17/2016 at 19:33 |

|

I guess Iím lucky. I am a member of two different credit unions that have no trouble giving me low interest rate loans for car being sold by dealers or private sellers. No converting from a personal loan or anything like that.

Congrats on the IS-F though.

Lastly, some states have begun moving to electronic titles.

Rand0nS

> TsarBomba

Rand0nS

> TsarBomba

01/17/2016 at 19:34 |

|

Silly reason for that. He just needs a better bank.

shop-teacher

> Birddog

shop-teacher

> Birddog

01/17/2016 at 19:34 |

|

Ooofff!!!!

But S-10 Baja!!!!!!!!!

skwimjim

> Torque Affair

skwimjim

> Torque Affair

01/17/2016 at 19:39 |

|

My parents bought a house in the early 1980's at 18%. You are doing okay.

shop-teacher

> Torque Affair

shop-teacher

> Torque Affair

01/17/2016 at 19:44 |

|

Well that stinks!

If it makes you feel better, my idiot ex-sister-in-law just took out a $10k loan at 31% interest. Payoff price over 5 years .... $27,000.

Torque Affair

> mad.anthony

Torque Affair

> mad.anthony

01/17/2016 at 19:44 |

|

hah, canít remember where I bought it....but Iíve had it for 5 years and it still works!

skwimjim

> Torque Affair

skwimjim

> Torque Affair

01/17/2016 at 19:46 |

|

A few years back I had a minor sewer backup which we discovered before it backed up into the house (which would have been covered by homeownerís insurance). $18,000 and two weeks later I had a shiny, new, not planned for, sewer lateral including excavating to a depth of 10' and having to repave a 16' square section of the road (NONE of which was covered by homeownerís insurance). Sometimes you lose; sometimes you lose big. I think you learned a pretty good lesson for your $300.

Torque Affair

> Rand0nS

Torque Affair

> Rand0nS

01/17/2016 at 19:50 |

|

Thanks...yea sounds like a UFCU thing.

Torque Affair

> skwimjim

Torque Affair

> skwimjim

01/17/2016 at 19:51 |

|

ouch, Yea I think my parents did the same thing...

Torque Affair

> skwimjim

Torque Affair

> skwimjim

01/17/2016 at 19:52 |

|

I did! Definitely wonít repeat the same mistake twice!

Torque Affair

> shop-teacher

Torque Affair

> shop-teacher

01/17/2016 at 19:53 |

|

ouch!!! Thatís horrible.

shop-teacher

> Torque Affair

shop-teacher

> Torque Affair

01/17/2016 at 19:57 |

|

It gets better ... She works at a bank.

didyourlysaythat?

> Torque Affair

didyourlysaythat?

> Torque Affair

01/17/2016 at 20:00 |

|

Fair enough, I guess itís also not a good idea to mess with the lienholder for 300$ but in retrospect Iíd probably follow up and see if you can get a credit due to their mistake.

300$ would put a good amount of gas in that tank :)

STL MANUAL

> Torque Affair

STL MANUAL

> Torque Affair

01/17/2016 at 20:01 |

|

Try LightStream next time, process is all online, no need to link title to them, you just promise you are using the loan for a car. 1.99% on a 60 month loan. Iíve swapped through 3 cars since I took the loan out in mid 14', I just waive cash in peopleís face, and have a clear title when I feel like selling..they never have sent me on piece of crap mail either.

You need great credit/income/assets to qualify, so it is not a fit for many, but has been my favorite customer transaction in my entire, longer than I would like to admit life.

Torque Affair

> STL MANUAL

Torque Affair

> STL MANUAL

01/17/2016 at 20:05 |

|

Oh thatís awesome! Yeah, Iíll have to look at it next time. Thanks for letting me know.

shirosake

> Torque Affair

shirosake

> Torque Affair

01/17/2016 at 20:24 |

|

God, it would crack me up if that damn thing turned on and shredded your 8 bucks. $300. AND $8.

DipodomysDeserti

> tapzz

DipodomysDeserti

> tapzz

01/17/2016 at 20:30 |

|

Yes? You don't get out much, do you?

DipodomysDeserti

> skwimjim

DipodomysDeserti

> skwimjim

01/17/2016 at 20:32 |

|

Fucking hell. I bought at 4%. Then I refinanced at 3% after a few years and was given a check for over $40k. I was also given $10k just for the hell of it when I bought the house. Thanks Obama! The Reagan years fucking sucked!

DipodomysDeserti

> skwimjim

DipodomysDeserti

> skwimjim

01/17/2016 at 20:41 |

|

Damn. So you're saying that extra insurance I bought to cover water/sewer lines outside of my house was a good idea?

Torque Affair

> shirosake

Torque Affair

> shirosake

01/17/2016 at 21:05 |

|

hahaha, you know that thought did cross my mind. Luckily, my 8 bucks stayed intact.

Nauraushaun

> Torque Affair

Nauraushaun

> Torque Affair

01/17/2016 at 21:07 |

|

I now know what it feels like to literally throw money down the drain

Figuratively*

DoesntLikeYou

> Torque Affair

DoesntLikeYou

> Torque Affair

01/17/2016 at 21:07 |

|

Well youíre right about the ďdonít do thisĒ sentiment then. If the idea of having a loan out at 11.9% makes you uncomfortable, donít come up with a plan that starts by taking out a loan at 11.9%.

Nauraushaun

> TsarBomba

Nauraushaun

> TsarBomba

01/17/2016 at 21:07 |

|

Dealers have a whole host of other issues to get past

jeffco

> Torque Affair

jeffco

> Torque Affair

01/17/2016 at 21:10 |

|

Good read and good advice about how convoluted a vehicle sale can be...BUT...I have a hard time feeling too sorry over a $300 glitch...I myself have had an experience with a vehicle title that includes (but not an all-inclusive list) homelessness, a 1972 Caddy bought in Denver, CO from a former resident of Ohio, a lost title/application for replacement, an attempted murder charge, 3 months of dealing with the Colorado state prison system as a non-relative of the incarcerated, and two months worth of failure to register tickets almost daily after the 30 day temp tag expired. Think you got a better story? Come at me bro... :)

Torque Affair

> DoesntLikeYou

Torque Affair

> DoesntLikeYou

01/17/2016 at 21:12 |

|

Well, I wouldnít have gone through the process with the IS-F had it not worked out beautifully with the 335i. But, now I know better!

Ryan G

> Torque Affair

Ryan G

> Torque Affair

01/17/2016 at 21:13 |

|

$300 isnít bad in the grand scheme of things, as others have said. Have you tried complaining to management at the credit union? Depending on how often you finance cars with them, it might be worth their money to keep you a happy customer and refund the difference in the interest rates. It was their screw up after all.

That being said, Iíd would start looking for a different credit union to use when you buy your next vehicle. Even if this one returns your money, if you can find another place that will write you the auto loan directly, that would be far easier way to go.

Torque Affair

> jeffco

Torque Affair

> jeffco

01/17/2016 at 21:14 |

|

Ok, you got me. Your story is insane. I wonít be able to top that.

highlandparkil

> Torque Affair

highlandparkil

> Torque Affair

01/17/2016 at 21:15 |

|

Donít buy a car you canít afford to pay cash for. Period, end of story.

If you donít have the money in the bank for the total price of the car, donít buy it.

Why would any pay interest on a depreciating asset.

Donít lease. Donít finance.

Be smart.

Torque Affair

> Ryan G

Torque Affair

> Ryan G

01/17/2016 at 21:24 |

|

Itís not, but yeah, Iíll go a different route next time. Lesson learned!

Torque Affair

> highlandparkil

Torque Affair

> highlandparkil

01/17/2016 at 21:26 |

|

When it doesnít make sense to pay cash is when you can make more on that cash through an investment, either in the market or a rental property or a business - whatever. If you can get a loan at a low rate, say 2% and you can make 8% on a rental property, then thatís a better use of cash.

Use money to make money - and then lose all of it to buy cars!

jeffco

> Torque Affair

jeffco

> Torque Affair

01/17/2016 at 21:27 |

|

Heh...you havenít even heard the story...but yeah my point was even simple cash transactions between private owners without banks involved can go horrifically off the rails...Iíve owned well in excess of 125 cars in my life, and seen just about every way there is to make a sale backfire. The caddy was the most epic, though.

Torque Affair

> jeffco

Torque Affair

> jeffco

01/17/2016 at 21:28 |

|

125 cars!?!? Holy crap. Whatís your net profit or loss after all those transactions? Just curious...

TheHotness

> Torque Affair

TheHotness

> Torque Affair

01/17/2016 at 21:32 |

|

Wait... you guys are all missing the point..

Congrats on the IS-F! Boom, pics or ban!

(Sorry about the 300 dollar lesson.. thanks for sharing.)

TheHotness

> TheHotness

TheHotness

> TheHotness

01/17/2016 at 21:33 |

|

Ack the greys! ARrr me matey; can you release me from the dungeons?

Torque Affair

> TheHotness

Torque Affair

> TheHotness

01/17/2016 at 21:36 |

|

Haha, theyíre coming! And videos...the good, the bad and the ugly - theyíre all coming.

Driving_Impaired

> Torque Affair

Driving_Impaired

> Torque Affair

01/17/2016 at 21:36 |

|

First off, I like your writing but please take the extra 10 minutes to proof read it. I always feel like a dick being a grammar nazi but come on, I think if anyone wants to be taken seriously as a writer (which it appears you do), then proofreading and limiting errors like this is a must.

c) Ask your buddy whoís a partner a law firm for some cash (he has more money than he knows what to do it )

Secondly, I have never heard of the ordeal you have to go through to buy a car via your credit union. In the past 5 years I have financed 5 different cars through my credit union to buy a used car from a private seller and every single time itís been the traditional loan process- none of this personal loan to transfer ordeal.

Hereís an even bigger kicker, my credit union is in NY (where I am from), but I live and all the cars I have purchased have been in GA. So.... you either have a terrible credit union, or I have the greatest one in the country. Either way, that sucks you have to deal with that.

Torque Affair

> Joneez

Torque Affair

> Joneez

01/17/2016 at 21:36 |

|

hahaha